What We’re Offering

We Provide Best Services For Analytics Financial Solutions

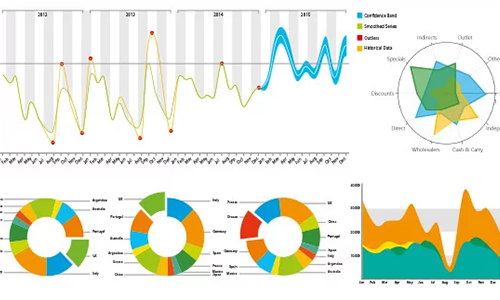

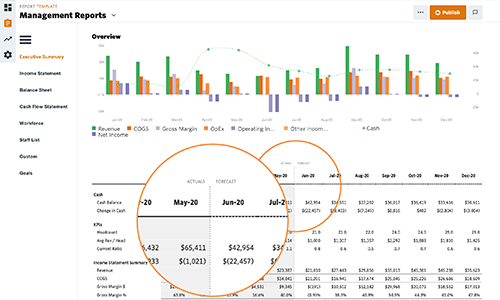

Analytics Software

Audit Assistance

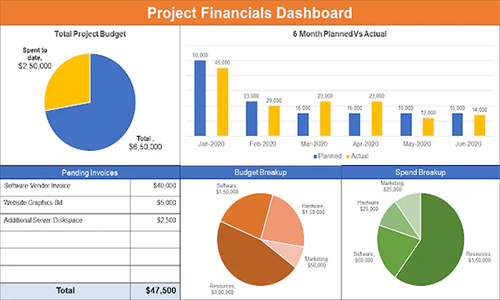

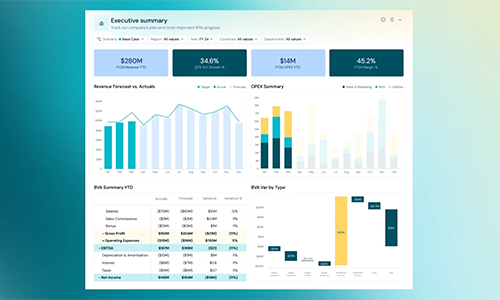

Financial Dashboard

Financial Consultation Software

Outsource Service

We deliver take outsource jobs on finance tasks like reporting, dashboarding, or internal controls—but not ready to hire full-time? I’m, a freelance financial expert offering seamless outsourced solutions:

Monthly Reporting & Variance Analysis

Custom Dashboard Design & Automation

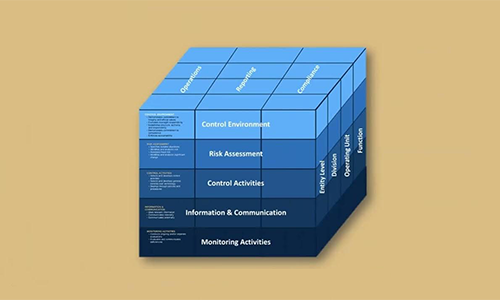

Internal Control Framework Development & Testing

Budgeting, Forecasting & Financial Modelling

Why Outsourcing To Me Works:

- Reliable & deadline-driven: I set clear timelines, provide regular updates, and deliver on time—every time (just like top-rated freelancers do)

- Smooth onboarding: I’ll gather your requirements upfront—no back-and-forth emails—and share status through shared documents and dashboards

- Cost-effective & efficient: You tap expert financial skills only when needed—no full-time overhead, just impactful results and process improvements.

Process:

- We start with your current finance setup and strategic goals.

- We craft a tailored delivery plan—reports, dashboards, or controls with clear ownership and timelines.

- You receive high-quality outputs and recommendations, freeing you to focus on growth.

Specialization

A Summary Of Our Services & Value Delivered

We analyse help companies improve their financial health, efficiency and liquidity by providing services around:

- Assess and optimize the use of consumables, hardware or other assets — avoid overstocking or under-utilization.

- Help implement optimal reorder / replenishment practices (based on demand patterns) to minimize cost and free up tied-up capital.

- Support procurement processes: vendor evaluation, standardization of purchasing, negotiation of favourable terms.

- Help clients negotiate payment terms and discounts, manage purchase cycles intelligently to align outflows with business cycles.

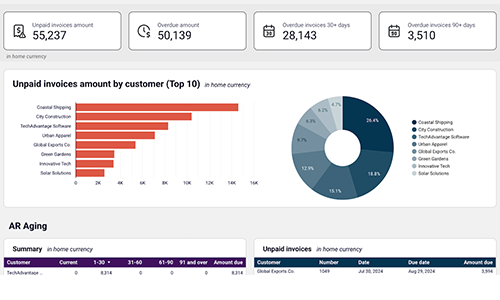

- Set up clear credit and payment-terms policies for clients, prevent overdue receivables.

- Accelerate invoicing and collections — helping business get paid sooner and improve cash-flow.

- Review and control indirect/overhead costs (utilities, office expenses, admin costs, non-essential spending).

- Monitor and manage recurring and non-recurring expenses to avoid wasteful spend and improve profitability. Alaan+1.

- Analyze working-capital metrics (receivables days, payables days, resource-holding) to identify cash-flow bottlenecks.

- Provide forecasting, financial planning and liquidity-management advice — helping companies maintain healthy cash balance, avoid cash crunch.

Let's Talk About How We Can Assist Improve Your Company's Analytics Financial Reports!