Streamline Your Accounts Data & Report

Your internal accounts team handles daily transactions and basic financial reporting reliably, you may be missing the advanced analytics and strategic insights required for critical decision-making—insights that normally demand hiring a highly experienced CFO or financial analyst at significant cost. Outsourcing offers a cost-effective alternative: you can gain CFO-level expertise and sophisticated MIS and analytics reporting without bearing full-time senior salaries. Rest assured, many firms already serve clients in both the Middle East and UK under strong data security and compliance standards.

Please check the enclosure. This is a presentation of my service for strengthening your finance & accounts data / report.

We undertake to keep all data so confidential and will not disclose for any purpose.

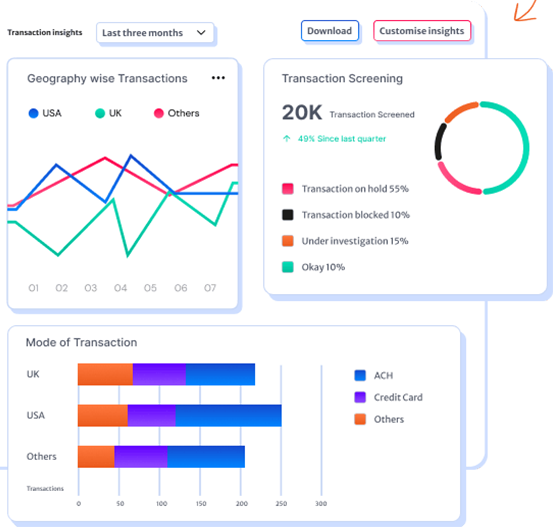

If you want to create an elegant dashboard finance report which auto- auto-reconciled, please contact +97150-9522362/ +971503960524).

UAE-based finance expert offering specialized accounting, bookkeeping, and MIS (Management Information System) reporting services for small and medium-sized enterprises across the globe.

20+

Years OfExcellence

We understand that managing financial operations internally can be both time-consuming and resource-intensive. Outsourcing these functions to us allows your business to benefit from:

-

Accurate and timely bookkeeping

-

Tailored MIS reports for better decision-making

-

Cost-effective solutions with access to experienced professionals

-

More time and resources to focus on your core business

Currently serving a wide range of industries, including:

-

Pharma & Dental Solutions

-

Advertising

-

FMCG & Café

-

Logistics

-

Farming & Agriculture

-

Play Chain & Entertainment Venues

-

Consultancy Services

-

Educational Institutions

A Summary Of Our Services & Value Delivered

We analyse help companies improve their financial health, efficiency and liquidity by providing services around:

- Assess and optimize the use of consumables, hardware or other assets — avoid overstocking or under-utilization.

- Help implement optimal reorder / replenishment practices (based on demand patterns) to minimize cost and free up tied-up capital.

- Support procurement processes: vendor evaluation, standardization of purchasing, negotiation of favourable terms.

- Help clients negotiate payment terms and discounts, manage purchase cycles intelligently to align outflows with business cycles.

- Set up clear credit and payment-terms policies for clients, prevent overdue receivables.

- Accelerate invoicing and collections — helping business get paid sooner and improve cash-flow.

- Review and control indirect/overhead costs (utilities, office expenses, admin costs, non-essential spending).

- Monitor and manage recurring and non-recurring expenses to avoid wasteful spend and improve profitability. Alaan+1.

- Analyze working-capital metrics (receivables days, payables days, resource-holding) to identify cash-flow bottlenecks.

- Provide forecasting, financial planning and liquidity-management advice — helping companies maintain healthy cash balance, avoid cash crunch.

Let's Talk About How We Can Assist Improve Your Company's Analytics Financial Reports!